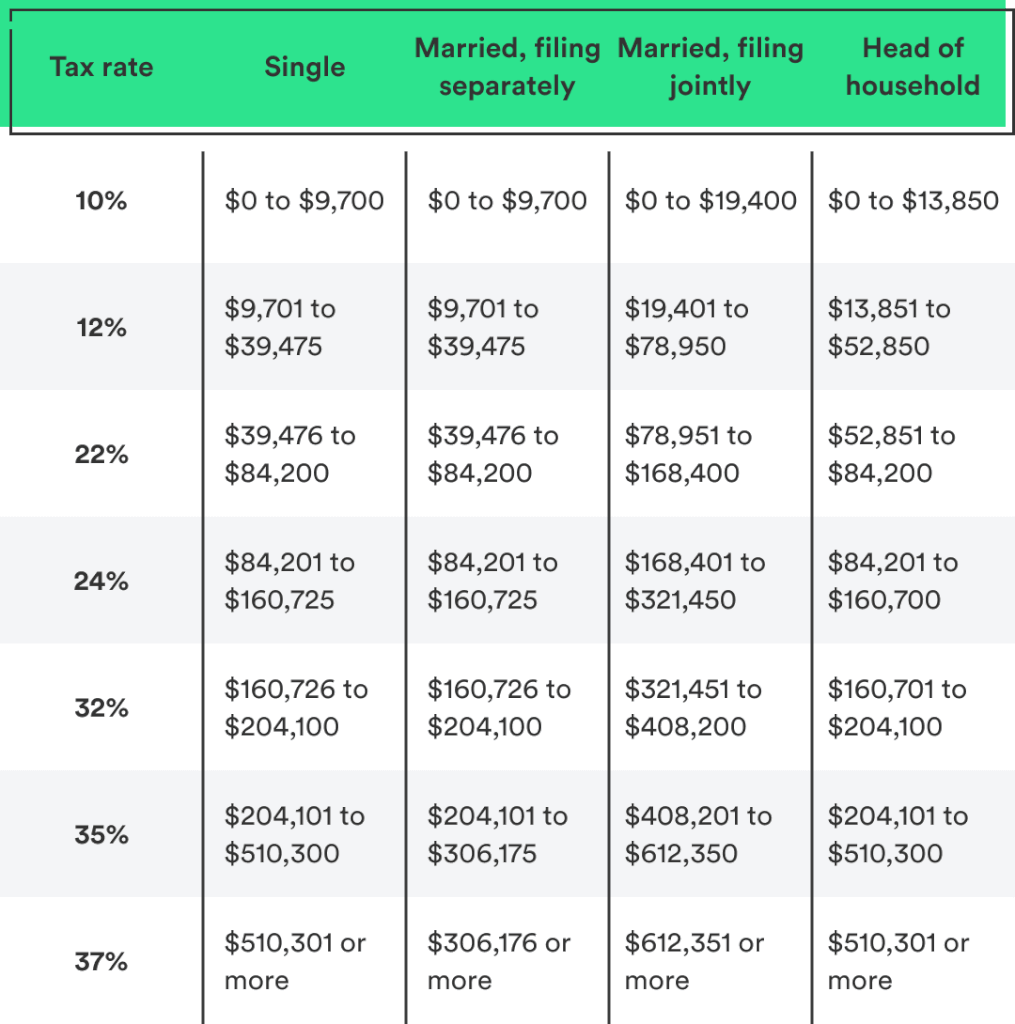

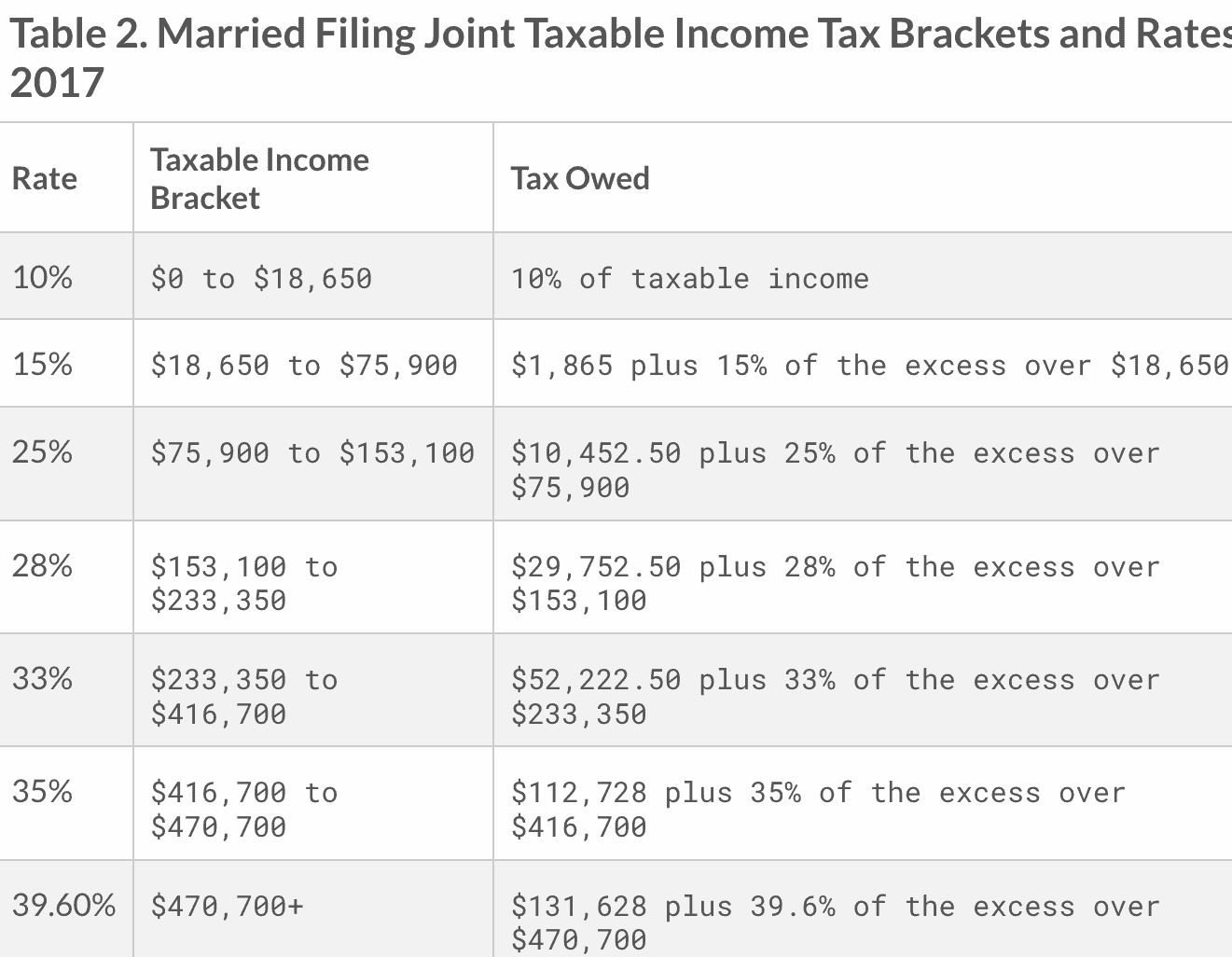

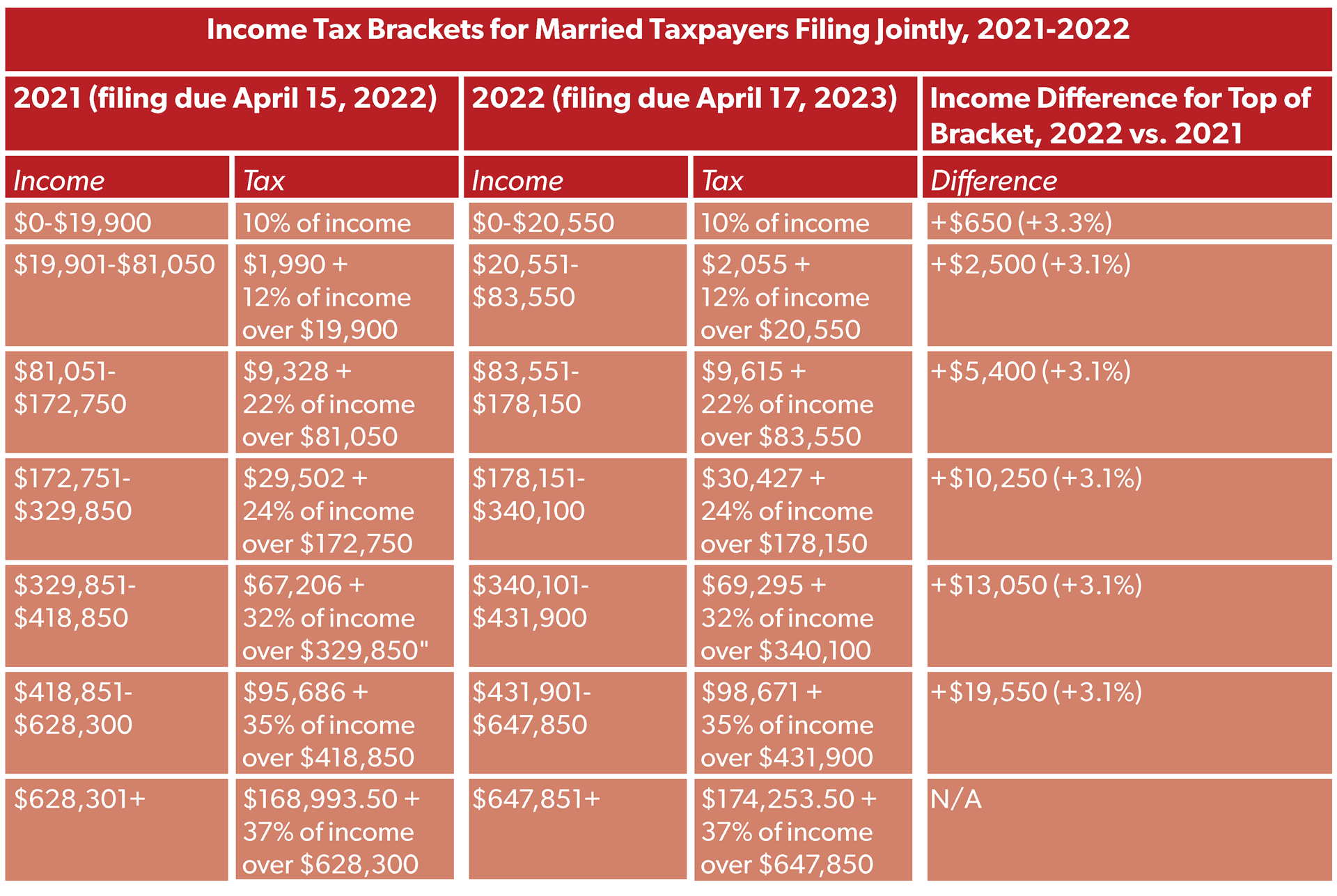

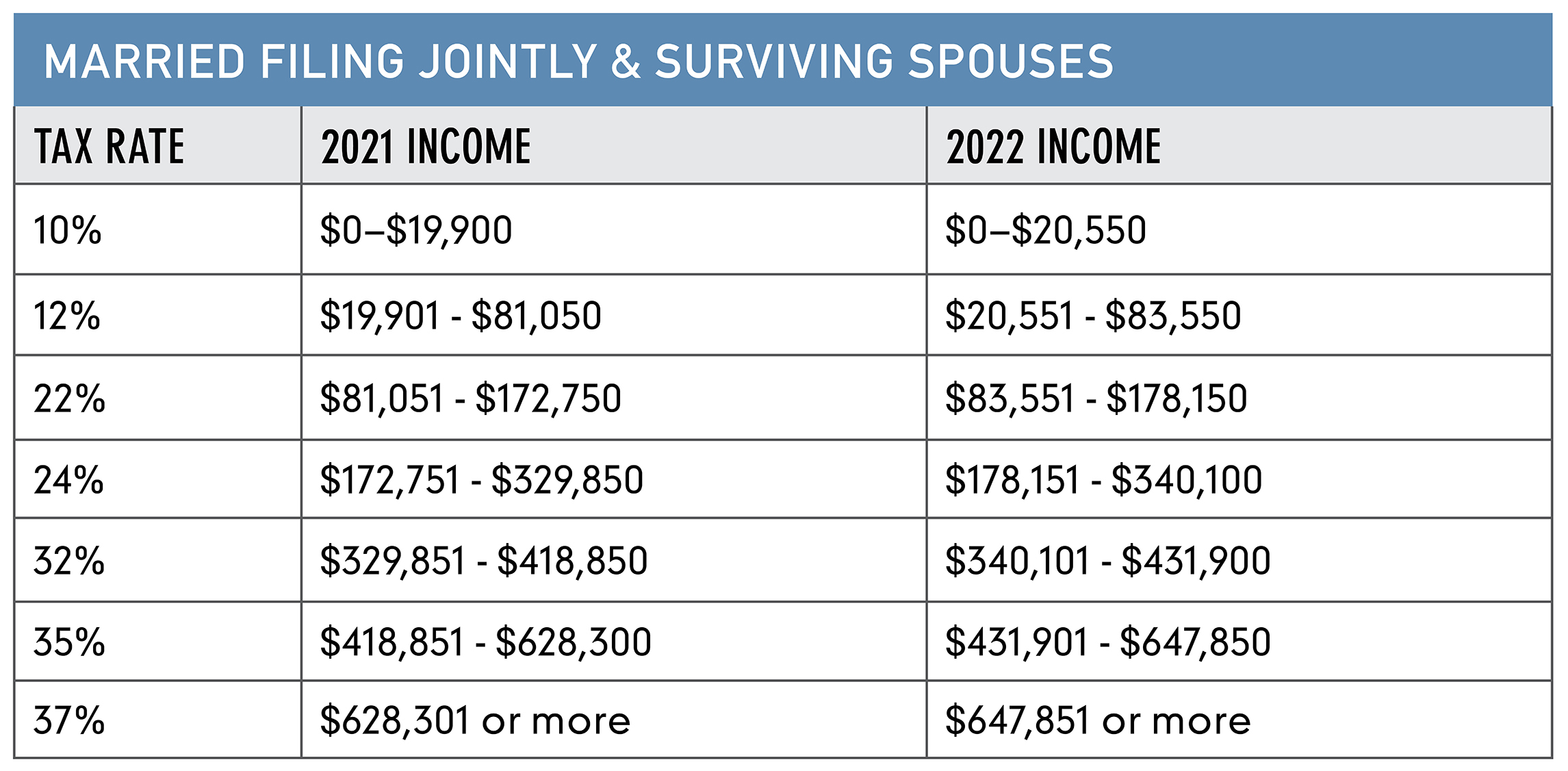

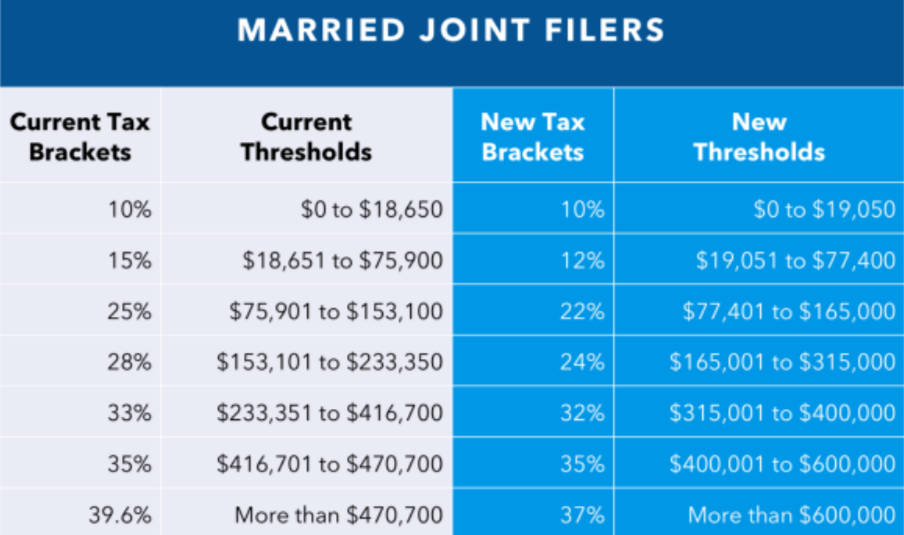

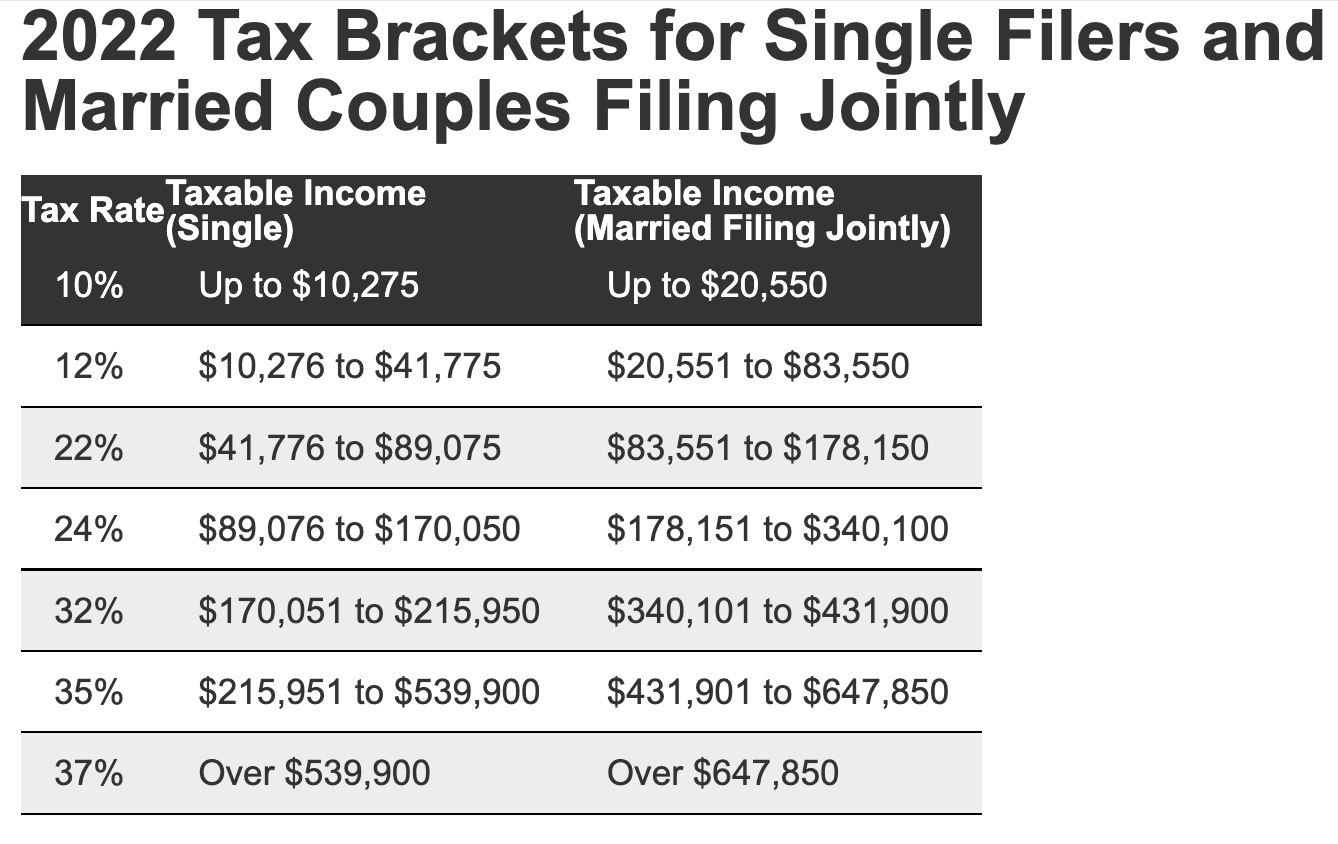

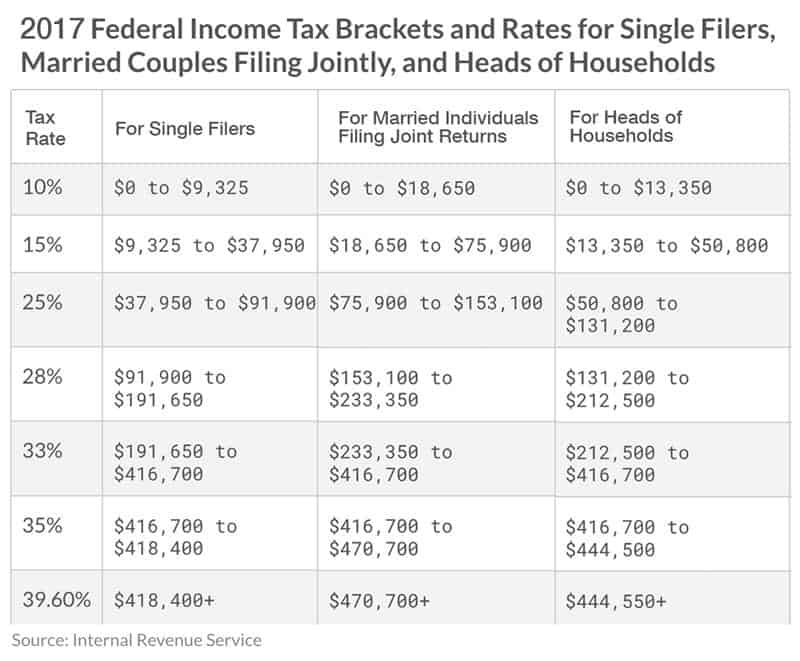

2025 Tax Brackets Married Filing Jointly Irs Modern Present Updated. There will also be changes for the standard. For example, just because a married couple files a joint return with $100,000 of taxable income in 2024 and their total taxable income falls within the 22% bracket for joint filers,.

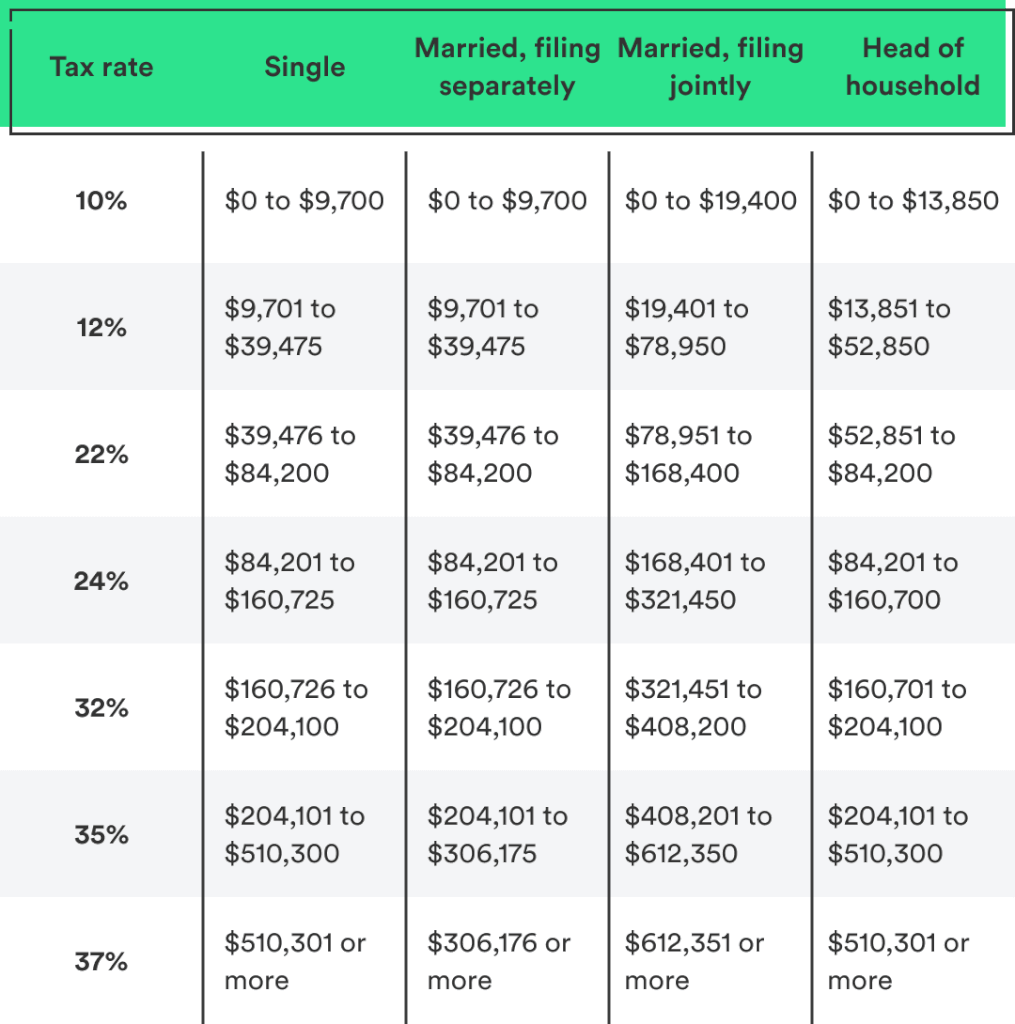

10% for single filers with incomes of $11,925 or less and for married couples filing a joint tax return with incomes of $23,850 or less. Here are the updated 2025 tax tables for various key irs thresholds, including the tax rate 2025: There will also be changes for the standard.

Source: dylancunninghamp.pages.dev

Source: dylancunninghamp.pages.dev

Tax Brackets 2025 Married Filing Jointly Dylan P. Cunningham Get all the news you need in your inbox each morning. There will also be changes for the standard.

Source: sherryrjohnson.pages.dev

Source: sherryrjohnson.pages.dev

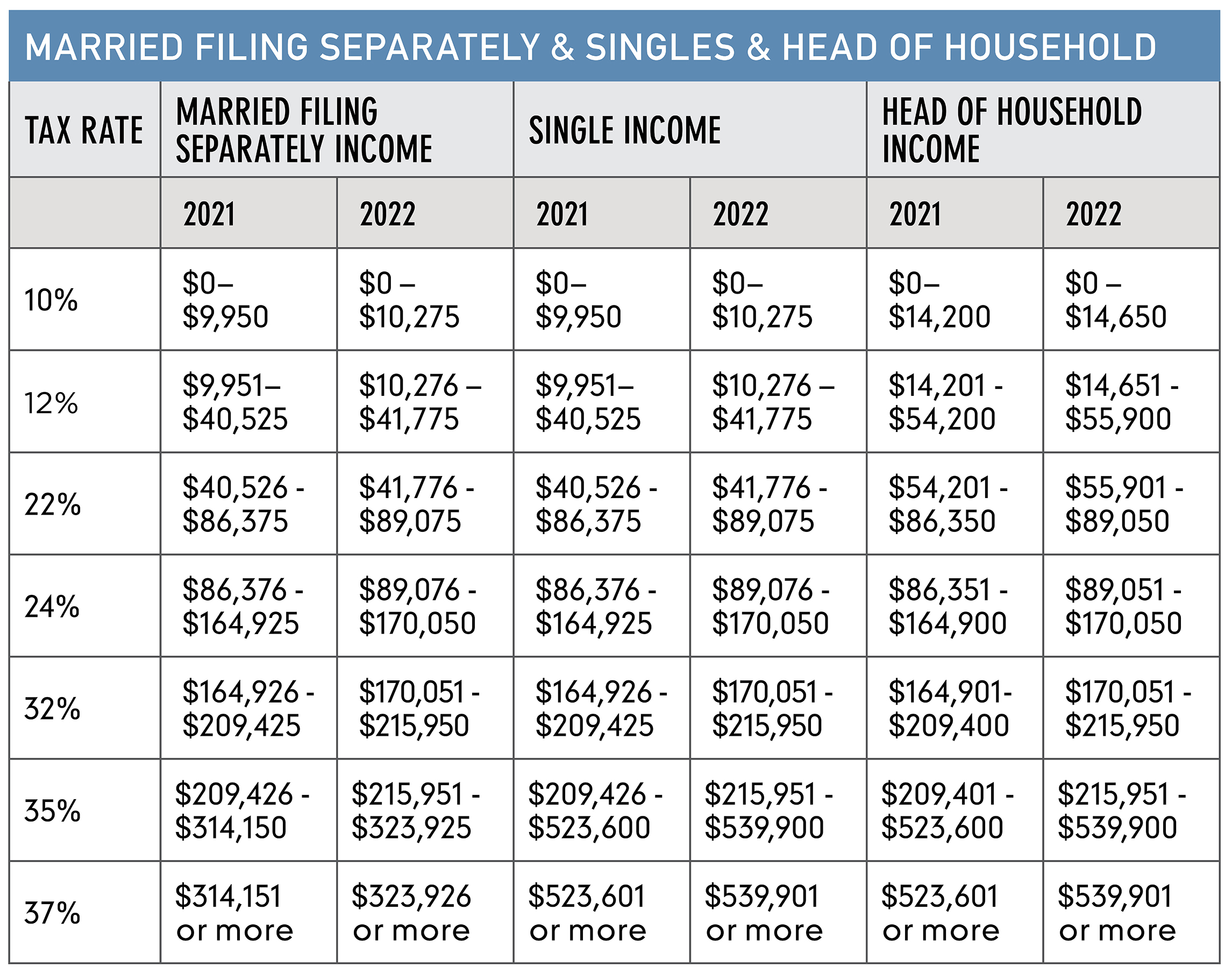

Irs Married Filing Jointly Tax Brackets 2025 Sherry R. Johnson The tax brackets, which reflect a 2.8% inflation adjustment, apply to income earned in 2025, with tax returns due in 2026. 10% for single filers with incomes of $11,925 or less and for married couples filing a joint tax return with incomes of $23,850 or less.

Source: rebeccanewbigins.pages.dev

Source: rebeccanewbigins.pages.dev

2025 Tax Brackets Married Jointly Married Filing Jointly Rebecca S There will also be changes for the standard. Here are the updated 2025 tax tables for various key irs thresholds, including the tax rate 2025:

Source: hannahmakutzz.pages.dev

Source: hannahmakutzz.pages.dev

Tax Brackets 2025 Married Filing Jointly Standard Deduction Hannah Z The tax brackets, which reflect a 2.8% inflation adjustment, apply to income earned in 2025, with tax returns due in 2026. There will also be changes for the standard.

Source: lillystephenh.pages.dev

Source: lillystephenh.pages.dev

Tax Brackets 2025 Married Filing Jointly Lilly H. Stephen Get all the news you need in your inbox each morning. For example, just because a married couple files a joint return with $100,000 of taxable income in 2024 and their total taxable income falls within the 22% bracket for joint filers,.

Source: hannahmakutzz.pages.dev

Source: hannahmakutzz.pages.dev

Tax Brackets 2025 Married Filing Jointly Standard Deduction Hannah Z Get all the news you need in your inbox each morning. There will also be changes for the standard.

Source: sherryrjohnson.pages.dev

Source: sherryrjohnson.pages.dev

Irs Married Filing Jointly Tax Brackets 2025 Sherry R. Johnson For 2025, the maximum earned income tax credit (eitc) amount available is $8,046 for married taxpayers filing jointly who. The tax brackets, which reflect a 2.8% inflation adjustment, apply to income earned in 2025, with tax returns due in 2026.

Source: elizachinkawa.pages.dev

Source: elizachinkawa.pages.dev

2025 Tax Brackets Filing Jointly Irs Eliza A. Chin Kaw Get all the news you need in your inbox each morning. 10% for single filers with incomes of $11,925 or less and for married couples filing a joint tax return with incomes of $23,850 or less.

Source: alicalynasl.pages.dev

Source: alicalynasl.pages.dev

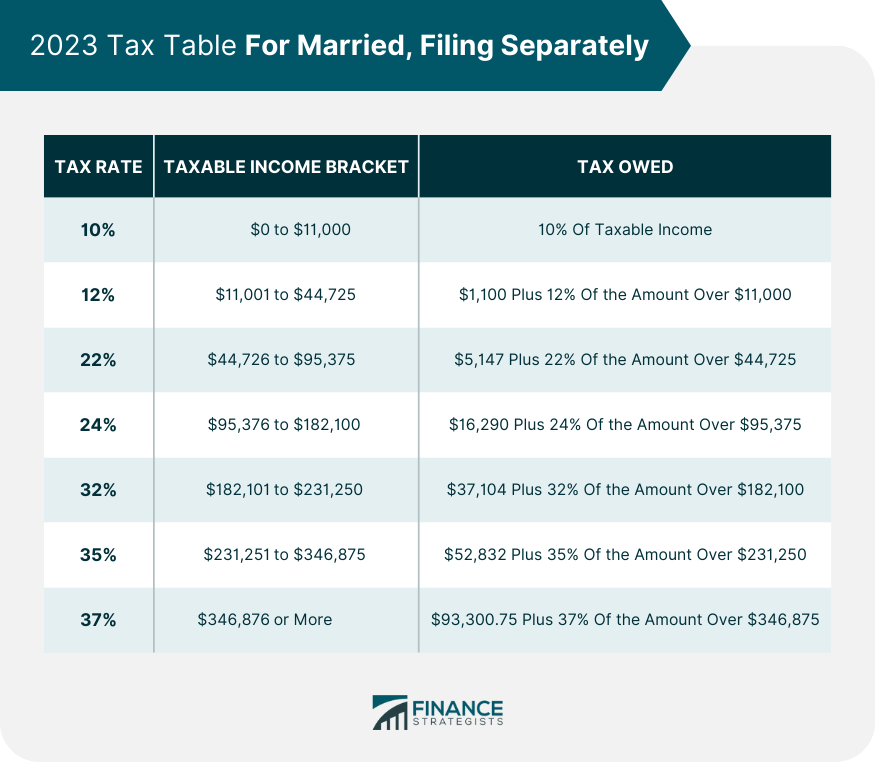

2025 Tax Brackets Married Filing Separately Calculator Alica L. Lynas Get all the news you need in your inbox each morning. For 2025, the maximum earned income tax credit (eitc) amount available is $8,046 for married taxpayers filing jointly who.

Source: jamesdcrabtree.pages.dev

Source: jamesdcrabtree.pages.dev

Tax Brackets For 2025 Married Filing Jointly With Dependents James D Find out your 2025 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns, heads of households,. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $626,350 for single filers and above $751,600 for married couples filing jointly.

Source: rosiehgadsden.pages.dev

Source: rosiehgadsden.pages.dev

2025 Tax Brackets Married Filing Jointly Irs Rosie H. Gadsden The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $626,350 for single filers and above $751,600 for married couples filing jointly. Get all the news you need in your inbox each morning.

Source: aliciafenstona.pages.dev

Source: aliciafenstona.pages.dev

Tax Brackets 2025 Table Married Filing Jointly Alicia A. Fenston Find out your 2025 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns, heads of households,. For example, just because a married couple files a joint return with $100,000 of taxable income in 2024 and their total taxable income falls within the 22% bracket for joint filers,.